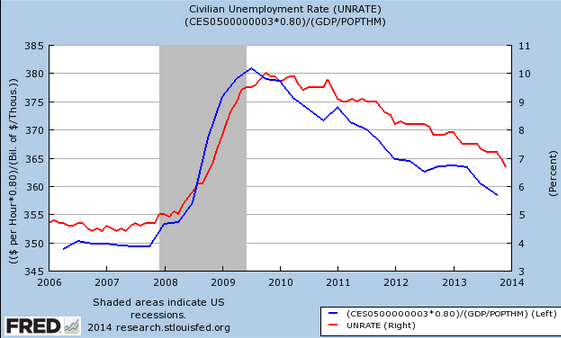

It’s been about 6 months since we’ve looked at the sticky wage model, so let’s see how it’s doing:

The fit seems better than ever. To my eyes it looks like “real wages” [(nominal average hourly earnings)/(NGDP/pop)] lead unemployment by about a month or two. That’s partly an artifact of a flaw in the St. Louis Fred graphing program. The (W/(GDP/pop)) data for Q4 is put in the October 2013 slot, whereas it should be November 2013. If you shifted the wage series one month to the right the correlation would look even closer.

The fit seems better than ever. To my eyes it looks like “real wages” [(nominal average hourly earnings)/(NGDP/pop)] lead unemployment by about a month or two. That’s partly an artifact of a flaw in the St. Louis Fred graphing program. The (W/(GDP/pop)) data for Q4 is put in the October 2013 slot, whereas it should be November 2013. If you shifted the wage series one month to the right the correlation would look even closer.

The musical chairs model does a great job of explaining both the onset of the recession, its intensity, and the slow pace of recovery. When the blue line gets down to about 350 the recession will be over and the red line (unemployment) will be in the 5% to 5.5% range.

More M*V plus sticky wages = recovery. It’s that simple, and always has been.

PS. Yichuan Wang has an excellent post over at Quartz explaining why it would be foolish for the Fed to try to pop bubbles.

via:http://www.themoneyillusion.com/?p=26122&utm_source=feedburner&utm_medium=feed&utm_campaign=Feed%3A+Themoneyillusion+%28TheMoneyIllusion%29

No comments:

Post a Comment